Maveric169

The Voices Talk to Me

- Joined

- 5 Dec 2002

- Messages

- 1,148

After nearly becoming a victim of Bank Of America twice now, and with no legal recourse possible I have decided that the very least I can do is warn people.

Bank of America engages in 3 activites that I know of that put you the consumer at risk and create an enviroment to commit banking fraud against you.

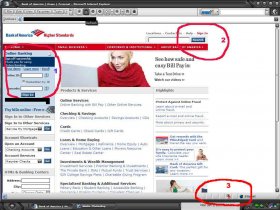

First lets start with how they put you at risk. The attached image is your BofA front page which has the ability for you to log in. I Marked it in Blue "1". But there is one problem with this if you look at the bottom right hand of the screen shot Marked in red "3" there is no security icon ensuring that all data entered on that page is secured and forced to use 128 bit encryption. Which "can" put you at risk to have your account login information stolen.

I say CAN, because while I am sure BofA has good security on thier servers to prevent someone from tampering with their site page, I know how secure my PC is and I would rather trust that then someone I do not know.

So how do you prevent this "Potential" security risk, simple, at the top right hand of the screen, marked in red "2", you will see a "login in" text link in red, click on that it will take you to another page with options to login to your type of account. You will notice that when you go through that login you will get your security icon. (see attachment "bofa Login")

Now on to how Bank of America tries to commit fraud............

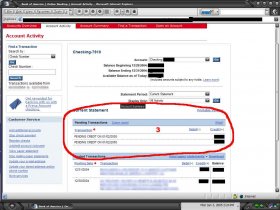

Ok so now how does Bank of America try to commit fraud against you? They do this 2 seperate ways or both. As you can see from the attachment, this is what your account page looks like. The area I circled and marked in red "3" is the pending transaction section. This area "SHOULD" tell you any and all pending transactions to your account. But does it? NO! It doesn't! As you can see from the screen shot, there are 2 pending transactions, but in reality I have 3! And this is the shady part, Bank of America only posts transactions to the pending section when they occur but remove them from that section after 12 hrs, (sometimes more sometimes less) but always before the actual transaction takes place.

So what does this mean? How is this fraud?

Here is how it works, BofA posts your pending transaction for 12 hrs or less and your balance will reflect the change, but once they remove that entry and long before the transaction posts to your account. so if you were to log in to check your balance after BofA removed the item from your pending transactions your balance would show that you have more money than you really do! Lets do an exercise.

You bank balance is $100, you make a purchase for $50. For 12 hrs after the purchase the purchase will show in pending transactions and your balance will be $50. After BofA removes the item from pending transactions your balance will show $100. Now you login to check your balance you see that you have a balance of $100 and nothing listed in pending transactions. If you forgot that you made that $50 purchase you might go and spend that $100. Or at least BofA is hopeing that you will.

So you think you have $100 you goto the club and spend $75, well guess what, your now $-25.00 in the hole, BofA charges you a nice fat $66 - $99 over the limit fee, and you are now $-91.00 - $-124.00 in the hole!

Now the second way BofA commits fraud against you is they will withhold transactions for as long as 3 weeks before post them to your account, but will post most of them immediatly if your account is over drawn. Lets do another example.

You account balance is $100, you make 7 $20 purchases, all on the same day, for a total of $140. BofA will post 6 transactions to your account making you overdrawn by $20. And will charge you the $66 - $99 fee. your balance is now $-86 - $-119. The next day they will post the 7th transaction, they will pay it, and hit you with another overdarw fee of $99. Leaving you with a balance of $-185 - $-218.

That is bank fraud, but nearly impossible to prove in court. BofA deliberatly will withhold additional overdrawn transactions and will post them a day after to charge you additional fees reguardless of when the transaction was made.

If you have direct deposite they will hold your direct deposit credit till they post transactions that will overdraw your account, charge you the fee then will process your direct deposit credit.

So how do you avoid being the victium of BofA? Two ways, first, use a differnt bank!, the second is to keep perfect and miticulas records of EVERY transaction you make, and NEVER trust the online balance shown! Only your own register balance that you keep. No other balance is accurate with BofA, NONE!!!

(see attachment bofa pending)

Bank of America engages in 3 activites that I know of that put you the consumer at risk and create an enviroment to commit banking fraud against you.

First lets start with how they put you at risk. The attached image is your BofA front page which has the ability for you to log in. I Marked it in Blue "1". But there is one problem with this if you look at the bottom right hand of the screen shot Marked in red "3" there is no security icon ensuring that all data entered on that page is secured and forced to use 128 bit encryption. Which "can" put you at risk to have your account login information stolen.

I say CAN, because while I am sure BofA has good security on thier servers to prevent someone from tampering with their site page, I know how secure my PC is and I would rather trust that then someone I do not know.

So how do you prevent this "Potential" security risk, simple, at the top right hand of the screen, marked in red "2", you will see a "login in" text link in red, click on that it will take you to another page with options to login to your type of account. You will notice that when you go through that login you will get your security icon. (see attachment "bofa Login")

Now on to how Bank of America tries to commit fraud............

Ok so now how does Bank of America try to commit fraud against you? They do this 2 seperate ways or both. As you can see from the attachment, this is what your account page looks like. The area I circled and marked in red "3" is the pending transaction section. This area "SHOULD" tell you any and all pending transactions to your account. But does it? NO! It doesn't! As you can see from the screen shot, there are 2 pending transactions, but in reality I have 3! And this is the shady part, Bank of America only posts transactions to the pending section when they occur but remove them from that section after 12 hrs, (sometimes more sometimes less) but always before the actual transaction takes place.

So what does this mean? How is this fraud?

Here is how it works, BofA posts your pending transaction for 12 hrs or less and your balance will reflect the change, but once they remove that entry and long before the transaction posts to your account. so if you were to log in to check your balance after BofA removed the item from your pending transactions your balance would show that you have more money than you really do! Lets do an exercise.

You bank balance is $100, you make a purchase for $50. For 12 hrs after the purchase the purchase will show in pending transactions and your balance will be $50. After BofA removes the item from pending transactions your balance will show $100. Now you login to check your balance you see that you have a balance of $100 and nothing listed in pending transactions. If you forgot that you made that $50 purchase you might go and spend that $100. Or at least BofA is hopeing that you will.

So you think you have $100 you goto the club and spend $75, well guess what, your now $-25.00 in the hole, BofA charges you a nice fat $66 - $99 over the limit fee, and you are now $-91.00 - $-124.00 in the hole!

Now the second way BofA commits fraud against you is they will withhold transactions for as long as 3 weeks before post them to your account, but will post most of them immediatly if your account is over drawn. Lets do another example.

You account balance is $100, you make 7 $20 purchases, all on the same day, for a total of $140. BofA will post 6 transactions to your account making you overdrawn by $20. And will charge you the $66 - $99 fee. your balance is now $-86 - $-119. The next day they will post the 7th transaction, they will pay it, and hit you with another overdarw fee of $99. Leaving you with a balance of $-185 - $-218.

That is bank fraud, but nearly impossible to prove in court. BofA deliberatly will withhold additional overdrawn transactions and will post them a day after to charge you additional fees reguardless of when the transaction was made.

If you have direct deposite they will hold your direct deposit credit till they post transactions that will overdraw your account, charge you the fee then will process your direct deposit credit.

So how do you avoid being the victium of BofA? Two ways, first, use a differnt bank!, the second is to keep perfect and miticulas records of EVERY transaction you make, and NEVER trust the online balance shown! Only your own register balance that you keep. No other balance is accurate with BofA, NONE!!!

(see attachment bofa pending)